No Hype Real Estate Investing is the premier real estate investing course for high income professionals, whether or not you own a rental property already or don’t even want to own property directly. Whether this is all brand new to you or whether you’ve been involved in real estate for years, this course can help you to reliably build wealth and accelerate your path to financial freedom.

Maximize Investment Returns and Tax Advantages

Real estate investing has a lot of advantages. Real estate offers high returns and low correlation with stocks and bonds. It is relatively easy and safe to reasonably leverage. Done properly, it carries substantial tax advantages. It is also one of the few areas of investing where your additional work and expertise has the potential to increase your returns. Adding real estate to your portfolio can speed your arrival to financial independence, where you can dictate how you spend your time. It can also provide passive income that can replace part or all of the income you are currently working so hard for. Whether you’re totally burned out on your current career or just want to cut back a little, real estate investing can offer a viable solution. Real estate returns come from income, appreciation, paying down debt, and tax advantages. No Hype Real Estate Investing will teach you how to maximize each of these.

Naturally, real estate investing also has disadvantages, including additional work, complexity, illiquidity, and hassle. No Hype Real Estate Investing will teach you how to minimize these disadvantages.

Combating All the Hype and Telling It Like It Is

For years we’ve had white coat investors asking us how to get started in real estate. They want someone they trust to tell them the truth about how it works. The truth about real estate is good enough. It doesn’t need to be embellished. Yet the majority of books, courses, seminars, and even forums on the subject out there are filled with hype, false promises, and even outright scams.

The main problem with hype is that it confuses people and gives them misinformation. They develop unrealistic expectations of how much work is involved, how long they will have to “stick with the program,” and how much risk is appropriate to take. When the inevitable real estate downturn shows its ugly head, they will find out that they are the ones “swimming naked.”

By the end of the course you will:

- Align your interest, available time, capital, and risk tolerance with the right type of real estate investment

- Be fluent in real estate vocabulary

- Confidently vet investment opportunities presented by others, as well as those you find yourself

- Identify ways to maximize your investment returns

- Understand how to minimize tax drag on your investment returns

Why Are Doctors So Interested in Real Estate Investing Now?

Interest in real estate investing among physicians and other high-income professionals seems to be at an all time high. There's no doubt that some of this interest has come from the exceptional returns that real estate, like stocks, has had over the last decade. It also helps that at least private real estate seems to have weathered the 2022 stock bear market and inflation crisis relatively well so far. Some of this interest may be fed by physicians who are running syndications, real estate investing groups, and teaching real estate courses. We may be partly responsible as well as we have picked up a fair number of real estate investing companies as website and podcast sponsors in the last couple of years. However, we don't think any of these really explains the phenomenon.

We think the interest really comes from two things. First, doctors have realized that their income is very vulnerable. The volume and corresponding income cuts in the spring of 2020 during the early months of the pandemic were substantial and sobering for many of us in private practice. Meanwhile, the burnout epidemic has done nothing but worsen. With burnout rates in the 50% range, the biggest financial risk to physicians is losing their ability to earn due to burnout. That risk is at least three times higher than becoming disabled, but you cannot buy burnout insurance like you can disability insurance. At the same time that physicians are feeling a need for another source of income and financial security beyond their earned paychecks, they are seeing peers—both online and in real life—having massive success with real estate investing. Leverage combined with hard work and excellent recent returns has enabled a lot of docs to gain enough income from real estate to provide them financial freedom.

Sometimes this is done in just a few years and even within five years of residency completion. Is it risky? Of course. Does it require hard work and learning a new body of knowledge and set of skills? Absolutely. But how many more EMR changes and administrative BS are you willing to put up with before at least considering doing something a little different?

Who is this course right for?

This course is for someone who is serious about real estate investing, even if you don’t have much capital to invest yet. While you do not need any prior knowledge, you are going to need some motivation. Sure, the course is lengthy (there’s a lot to learn and we want you to get your money’s worth out of it). But the truth is that taking the course is only the beginning of the hard work required to succeed in real estate investing. However, by the end of the course you will know how to efficiently apply your efforts toward success, saving you tons of work and mistakes down the line.

Why do you have to be serious to take the course? Well, we’ll sell it to anyone, but it’s not cheap. This is a high-quality, premium online course. Don’t worry, it is more than fairly priced, but it is also arguably the best piece of content ever produced at The White Coat Investor, including the blog, the podcast, the books, the newsletters, and all of our other courses. Since the course isn’t cheap, buying it represents a commitment to actually taking the course. To actually educating yourself. To actually moving forward and becoming a real estate investor.

Who is this course not right for?

If you only have an hour to learn about real estate investing, this isn’t for you. It’s going to take a lot more of a commitment than that, not only to take the course, but to be successful with real estate. You can build a portfolio of index funds in an hour (take our Fire Your Financial Advisor course to learn how to do that), but that’s not going to cut it with real estate. Too much complexity. This course isn’t priced for students and residents. It compiles the most high-yield real estate information out there into one place to efficiently use the time of high-income professionals. If you’re having to choose between eating and buying this course, please don’t buy this course. Go down to the grocery store and spend your money there. However, if you now have capital that you know you need to put to work but are afraid that you will make a mistake doing so, this course is for you.

This course is not going to teach you the basics of budgeting, saving, personal finance, portfolio construction, insurance, and estate planning. You would be far better off taking Fire Your Financial Advisor first. Come back for this one after you’ve mastered that.

The Most Important Thing in Real Estate Investing

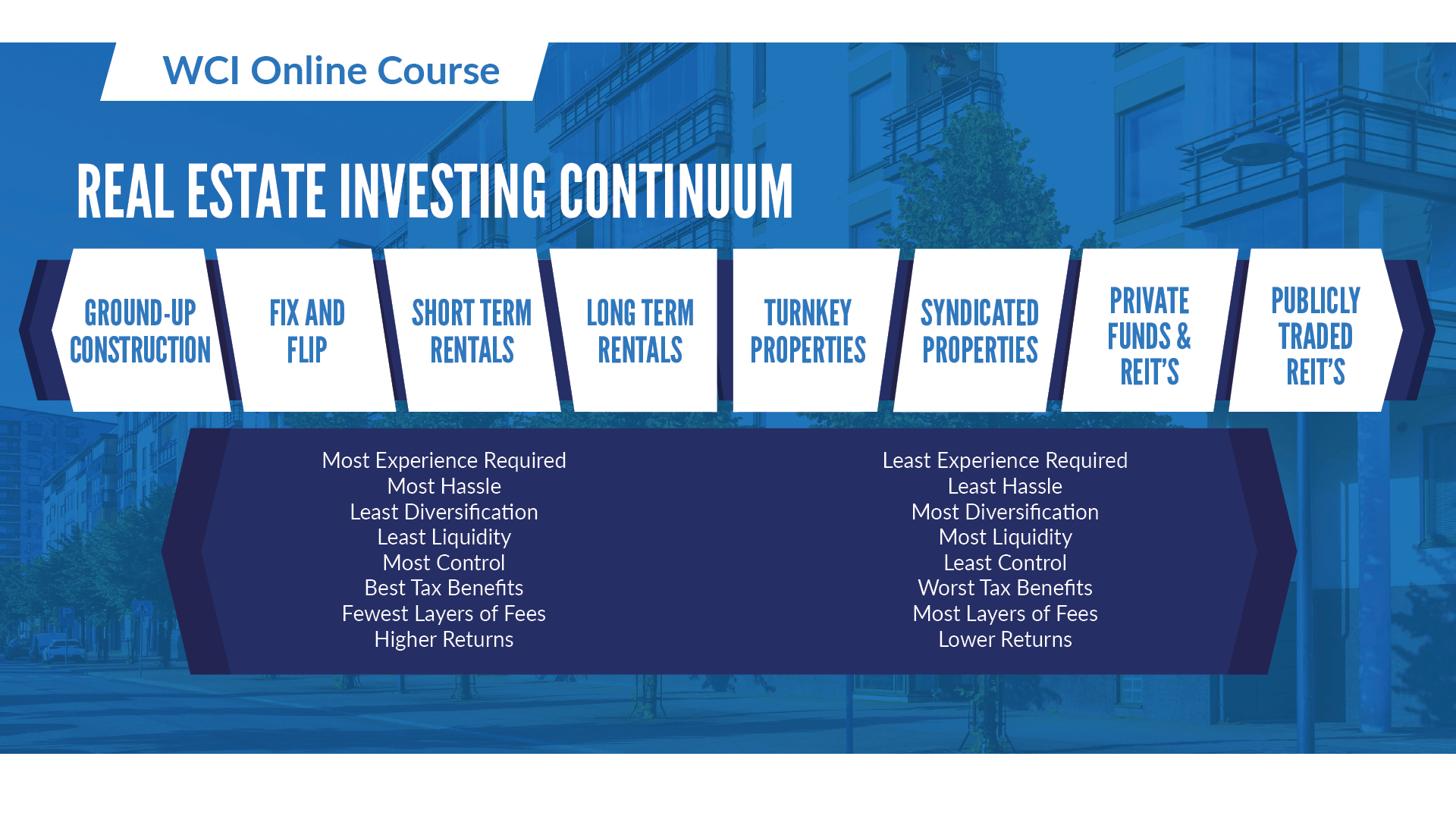

The most important thing in real estate investing is matching your style of investing to you. To your goals. To your desire to participate in the investment. To your need for control. Even if you don’t want to own a property and only have a few thousand dollars to invest, you can still invest in real estate and there is still a style of investing that is right for you.

How much do you have to invest? How much is enough diversification? What are your skills and what is your level of expertise? Most importantly, how much work are you willing to put into it? How much does it bother you to pay fees to others? There are options that run the whole gamut of the real estate spectrum.

On the left side, you can see the more active side of investing. This usually involves buying and, often, managing property yourself. This includes fix-and-flip investing, short-term rental investing, and directly investing in single-family homes, condos, duplexes, and apartment buildings. On this end of the spectrum, you maximize your returns, tax benefits, and control, but it comes at the cost of more work, hassle, required expertise, and lack of diversification.

As you move across the spectrum you encounter more passive investing options, including syndications, private real estate funds, public and privately traded REITs, and even mutual funds that invest in REITs. Diversification improves and the hassle dramatically drops, but there is a cost. You pay more in fees and you lose control, tax benefits, and possibly even some of your returns. The trick is figuring out the right place on the spectrum for you to invest. It isn't that there is a right way and wrong way to invest in real estate, but there is a right way for you and it is important that you recognize it and concentrate your efforts there.

No Hype Real Estate Investing will teach you about all of these styles of investing, but most importantly, it will help you to recognize where you fit in on the real estate spectrum so you can concentrate your efforts there.

Isn’t real estate investing risky?

Yes, it is. And anyone who tells you otherwise is lying to you. We won’t lie to you. Investing is all about risk management. We’ll show you where the risks are in real estate investing and help you to decide which ones are worth running. We want you to take on an appropriate amount of risk so you can reach your goals, but not so much that you find yourself unable to sleep at night, or worse, facing bankruptcy during a real estate downturn.

Can I make more in real estate than stocks?

Yes, you can. You can also make less. The No Hype Real Estate Investing course will help you to decide how much risk to take to get that level of return that you need to reach your goals. This isn’t a get rich quick scheme. It is still going to take years to be successful. But we’ll show you not one, but many viable pathways to real estate wealth.

What’s in the Course?

We've developed an introductory course to real estate investing that we think everybody should take before they start real estate investing in any form. This course will provide the education required to understand real estate, all the way from fix-and-flips and short-term rentals to publicly traded REIT mutual funds. This course will give you confidence to look beyond the hype, evaluate and select the right deals for you, and know you have the foundational education you need to succeed in this endeavor. The course provides a framework for developing further knowledge and experience as you progress in your real estate investing career. We call it an introductory course because there is always more to learn. But this is no short, superficial course. There are 200+ lectures/videos in it and more than 27 hours of content by more than a dozen instructors. This may very well be the only course that many people need, while others may continue their education afterward by taking more courses.

The No Hype Real Estate Investing Course will take you through the entire continuum, with a module about every style of real estate investing on the spectrum. In addition, the course will teach you the vocabulary of real estate and how to do all the necessary real estate calculations. Don't worry, none of them require anything beyond fourth-grade math and the use of a simple spreadsheet or calculator.

If you want to build an empire of small apartment buildings in your hometown, this course will get you started. If you want to buy a couple of turnkey single-family home rentals across the country, this course can show you how. Think you have the capacity to take on some fix-and-flips? We'll show you the ropes. Want to run a short-term rental business? We'll show you how much to pay the housekeeper, what you need to stock the kitchen with, and how to scale from one unit to 30. Or perhaps you are just looking for an asset class to add to your portfolio that will have solid returns and low correlation with your stock index funds. We will show you how to earn an illiquidity bonus using private equity funds and how to get large amounts of passive income using private debt funds. We'll show you how to evaluate a syndication, so you can increase the likelihood of earning the projected returns and not get suckered by an overly optimistic, inexperienced operator trying to rip you off. We'll even teach you the best way to invest in public REITs.

We're going to teach you all of the tax benefits of real estate investing and how to qualify for each of the deductions. You'll learn how to do your real estate-related taxes yourself, or better yet, how to hire an experienced CPA specializing in real estate to help you.

We will introduce you to the other players and resources in the physician real estate investing space. They are co-instructors in the course, sharing their expertise in their specialized areas. If you want to learn more about their niche subjects, we'll show you how to get involved and provide you with the best deals to join their communities and take their courses for additional specialized education.

Most importantly, we'll inspire you to take the next step. Knowledge is power, but without action, it won't get you any closer to your goals. You'll hear from other physician real estate investors who have done and are doing exactly what you want to do. There is even a pre-test and a post-test if you want to test how well you're picking up the knowledge. And we'll do all this without blowing smoke or promising outcomes that are too good to be true.

This is a multi-instructor course. We've found the best of the best in the physician real estate investing space to teach you how to be successful like them.

Check out this star-studded faculty:

- James M. Dahle, MD, Founder of the White Coat Investor

- Disha Spath, MD, WCI Ambassador

- Leif Dahleen, MD, Founder of Physician on FIRE

- Cory Fawcett, MD, Founder of Financial Success MD

- Chad Doty, CEO of 37th Parallel

- Don Wenner, CEO of DLP Capital

- Larry Hickernell, Senior Director of DLP Capital

- Jilliene Helman, CEO of RealtyMogul

- Michael Episcope, CEO of Origin Investments

- Paul Moore, CEO of Wellings Capital

- Anthony Morena, Founder of Mortar Group

- Jim Sheils, Founder of JAX Capital

- Joe Ollis, CIO of The Peak Group

- Michelle Schmidt, Realtor

- Jon Schmidt, MD, Real Estate Investor

- Sabitha Setty MD, Founder of The Unorthodox Doc

- Param Baladapani, MD, Founder of Generational Wealth MD

Take a look at the course layout:

Course Curriculum

- Real Estate Asset Classes (10:28)

- Property Grades (A,B,C,D) (3:06)

- Strategies: Core, Core-Plus, Value-Add, Ground-Up, Opportunistic (4:17)

- What Is Active vs. Passive Real Estate (1:38)

- What Is Crowdfunding? (1:54)

- Accredited Investor vs. Qualified Client vs. Qualified Purchaser (12:40)

- Real Estate Calculations (0:45)

- Gross Scheduled Income (1:14)

- Gross Operating Income (1:23)

- Net Operating Income (1:39)

- Capitalization Rate (2:25)

- Taxable Income (1:09)

- Cash Flow Before Taxes (0:39)

- Cash Flow After Taxes (1:25)

- Cash on Cash Return (1:32)

- Payback Period (0:50)

- Internal Rate of Return (2:06)

- Equity Multiple (1:34)

- Return on Equity (1:40)

- Estimating the Value of a Property (3:37)

- Gross Rent Multiplier (1:57)

- Interest Calculations (2:23)

- Rule of 72 (0:53)

- Per Unit Calculations (1:43)

- Operating Expense Ratio (0:53)

- Debt Service and Debt Coverage Ratio (1:13)

- Loan to Value Ratio (1:19)

- Break Even Ratio (0:52)

- Points (1:07)

- Maximum Loan Amount (1:49)

- Payments and Principal Payments (2:50)

- Glossary of Real Estate Calculations

- 401(k) vs. Real Estate (6:17)

- Withdrawing Money from Your 401(k) to Invest in Real Estate (6:08)

- Borrowed Money (3:27)

- Using Retirement Accounts to Invest (1:33)

- Cash Value Life Insurance (2:04)

- How Much Leverage to Use (6:16)

- How to Balance the Benefits of Leverage with a Desire to Be Debt Free (10:19)

- How to Think About Debt (42:35)

- Debunking the Infinite Return and Buying Real Estate with No Money (10:59)

- Passive Real Estate Investing (6:06)

- The Case for Private Real Estate (3:50)

- Why You Need to Be an Accredited Investor vs. Qualified Client vs. Qualified Purchaser (7:50)

- Completed Equity Deals at Realty Mogul (9:35)

- How to Find Funds (4:07)

- The Dilemma of the Minimum Investment (4:11)

- Fee Structures and Waterfalls (15:43)

- Access Funds (1:31)

- Why the Manager Matters Most (1:47)

- How to Do Due Diligence on a Manager (4:11)

- Match Day: Finding the Right Manager for You (4:05)

- Questions About Managers You Need Answered (13:04)

- Debt Funds (3:53)

- Unique Types of Funds to be Aware Of (2:04)

- How Is a Property Chosen to Be Placed in a Fund (4:00)

- What to Look for When Evaluating a Fund (2:26)

- How to Choose a Fund Manager (35:39)

- Overview of Syndications (1:27)

- The Market: Top-Down Analysis (9:21)

- Bottom-Up Analysis (5:52)

- Expenses and Cash Flow (7:36)

- Returns and Performance Indicators (11:12)

- Capital Stack and Debt Structure (16:12)

- Capital Improvement Plans (3:26)

- Valuations (3:03)

- How Operators Can Juice Returns (7:29)

- How to Do Due Diligence on a Syndication or Fund Manager (15:13)

- How to Evaluate Value Add Investment Offerings (49:14)

- How to Evaluate Ground Up Build Investment Offerings (28:36)

- 10 Critical Rules for Successfully Investing in Syndications (47:47)

- Introduction to Long Term Rentals (3:27)

- Philosophy (7:32)

- Setting Rents (15:05)

- Advertising (5:47)

- Leasing (6:22)

- Move-Ins and Move-Outs (5:12)

- Maximizing Income (5:29)

- Policies and the Lease Agreement (8:46)

- Minimizing Expenses (8:43)

- Resident Managers (6:50)

- Hiring a Property Management Company (3:29)

- Tips and Tricks for Single Family Homes (3:35)

- Insurance (3:21)

- Bookkeeping and Cash Management (2:18)

- Buying Properties (7:53)

- Buying Properties with No Money Down (5:42)

- Selling a Property (1:57)

- House Hacking (4:46)

- NNN Properties (1:34)

- Implementing Systems for Direct Real Estate Investing (45:18)

- Buying My First Rental Property (6:55)

- Long Term Rental Case Study (65:45)

- Introduction to Short Term Rentals (9:08)

- Choosing a Market (7:06)

- Analyzing Properties (12:08)

- Buying a Property (10:02)

- How to Manage a Short Term Rental (22:50)

- Setting Up Your Listings (12:05)

- Troubleshooting (6:02)

- Scaling the Portfolio (6:11)

- Additional Tips for Success (6:13)

- Roadmap to Investing in Short Term Rentals (22:05)

- Introduction to Tax Benefits (1:24)

- Philosophy (10:19)

- Basics of the Tax Code (11:41)

- Investing in Real Estate Using Retirement Accounts (8:43)

- What Taxes Do You Pay (4:24)

- Writing Off Expenses (5:23)

- Depreciation (10:03)

- REIT Structure (3:37)

- 1031 Exchange (4:23)

- 721 Exchange (UpREIT) (0:52)

- Opportunity Zone Investments (2:18)

- 199A Deduction (2:50)

- Filing Extensions (2:24)

- Multiple State Tax Returns (3:18)

- Home Office Deduction (1:54)

- Home Equity Exclusion (4:30)

- Real Estate Professional Status (REPS) (5:59)

- Short Term Rental Loophole (2:18)

- Introduction to the K-1 (9:14)

- Schedule E (4:37)

- Forms 8949 and 4797 (1:25)

- Tax Benefits of Short and Long Term Rentals (44:10)

- Bringing It All Together (3:18)

- Putting Together a Team (10:22)

- How to Become a Realtor (5:43)

- Joining a Community (3:00)

- Real Estate Books (4:34)

- WCI Resources (2:48)

- Financial Success MD (16:43)

- Generational Wealth MD (13:28)

- 37th Parallel (70:21)

- DLP Capital (6:52)

- JAX Wealth Investments/ SI Homes (5:28)

- Mortar Group

- Wellings Capital (30:01)

- The Real Estate CPA (4:30)

- Passive Advantage – LP Deal Analyzer Tool (39:21)

Frequently Asked Questions

How can I take No Hype Real Estate Investing?

The only thing you have to do to get started is to enroll. However, once you have purchased it, it is up to you. You can take the whole thing in one week if you dedicate yourself to it like a full-time job. Or, like most people, you can spread it out over a month or two or even 10. The course is self-paced, completely open, and evergreen. While designed to be done in order, you can skip around to your heart's content. You can enroll at any time. There are already over 200 videos in the course, and we’ll add to it from time to time going forward at no additional charge to previous purchasers. There is no ongoing cost or subscription fee, and as always, there is a money-back guarantee.

Is there any other way to learn this information?

Sure, you can learn it the same way we learned it. You can go read books, participate on forums for years, talk to experienced real estate investors, and peruse the internet for hours on end. You can then go out and start making mistakes. Hopefully you only make each mistake once before you learn your lesson. We don’t pretend to have exclusive access to the one true way to invest in real estate or any particular real estate secrets. We don’t think you should listen to anyone who does make that claim. The value of No Hype Real Estate Investing is in having all of this information selected, filtered, and compiled in one place and explained clearly in a way that will allow you to get started right away.

How much does the course cost?

The regular price is $2,199.

Do I have to take it right now to get that price?

No. You can buy it now, lock in your savings, and take it later, no problem.

What if I don’t like the course?

We know this course costs a lot of money. We also know that almost everyone who buys this course is going to love it so much that they will keep it, take it, implement what they learn, and change their lives. However, if you are one of the few who doesn't, we don't want you to be unhappy. So we have a no-questions-asked, money-back guarantee. So long as you purchased it less than one week ago and have taken less than 20% of it, we'll give you all of your money back if you just email [email protected] and let us know. That means there is no risk to you. You can try it out before you are committed to buy it.

Is there any other discount available?

No. We don’t care if you’re a student, resident, PA, military member, veteran, or our mother. We think we’re offering this course at a fair price considering everything it contains. There are no similar courses. Many courses that don’t offer anywhere near as much information sell for $3,000, $5,000, or even $10,000. Our regular price is already a huge discount. This course is 4 times as long as our flagship Fire Your Financial Advisor course yet we are selling it for only 2.5 times the price.

Why don’t you give the course away for free?

Do you work for free? Neither do we. And we put a whole lot of work into this course. Besides, there is a truism in life that we value something more when we have to pay for it. We want you to value this course and actually take it because we know it will help you.

What if I have questions?

The best way to get answers now or after purchase is to simply email [email protected]. While we don’t answer those emails 24/7/365, we’ll get back with you in a timely manner. Not only do we want you to buy this course, but we want you to be happy with it after you buy it.

Can I listen to this course in my car or while working out?

While we don’t want you watching videos while driving, if you have an IPhone or Ipad, you can use the Teachable app to listen to the course like you would a podcast.

Does the course qualify for CME?

No. The course does not currently qualify for Continuing Medical Education or dental CE. However, material may be added at a later date that would allow it to qualify for CME. If you’re looking for a WCI course that qualifies for CME, we recommend Financial Wellness and Burnout Prevention for Medical Professionals and the Continuing Financial Education courses. You can also attend the Physician Wellness and Financial Literacy conference held once per year. Those both qualify for CME. Each also contains some information about real estate investing, but nowhere near what is found in No Hype Real Estate Investing.